The Rule of 72

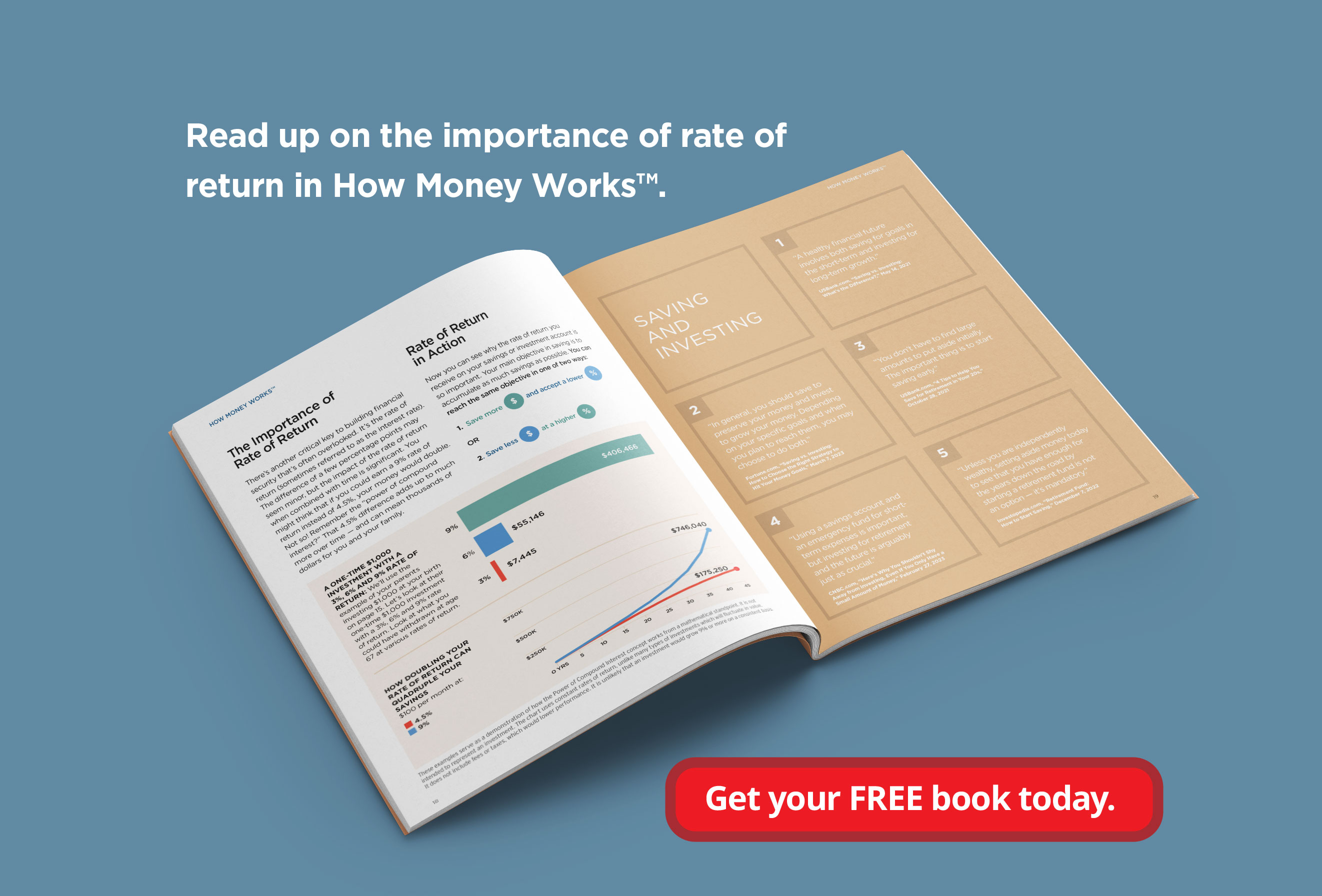

Do you know The Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double.

To calculate, take the number 72 and divide it by the rate of return you hope to earn. That number gives you the approximate number of years it will take for your money to double.

Based on The Rule of 72, a one-time contribution of $10,000 doubles six more times at 12 percent than at 3 percent over 48 years. Combined with time, you can see why rate of return is key.

| Years | 3% | 6% | 12% |

|---|---|---|---|

| 0 | $10,000 | $10,000 | $10,000 |

| 6 | — | — | $20,000 |

| 12 | — | $20,000 | $40,000 |

| 18 | — | — | $80,000 |

| 24 | $20,000 | $40,000 | $160,000 |

| 30 | — | — | $320,000 |

| 36 | — | $80,000 | $640,000 |

| 42 | — | — | $1,280,000 |

| 48 | $40,000 | $160,000 | $2,560,000 |

This table serves as a demonstration of how the Rule of 72 concept works from a mathematical standpoint. It is not intended to represent an investment. The chart uses constant rates of return, unlike many types of investments which will fluctuate in value. It does not include fees or taxes, which would lower performance. It is unlikely that an investment would grow 10% or more on a consistent basis.

La regla del 72

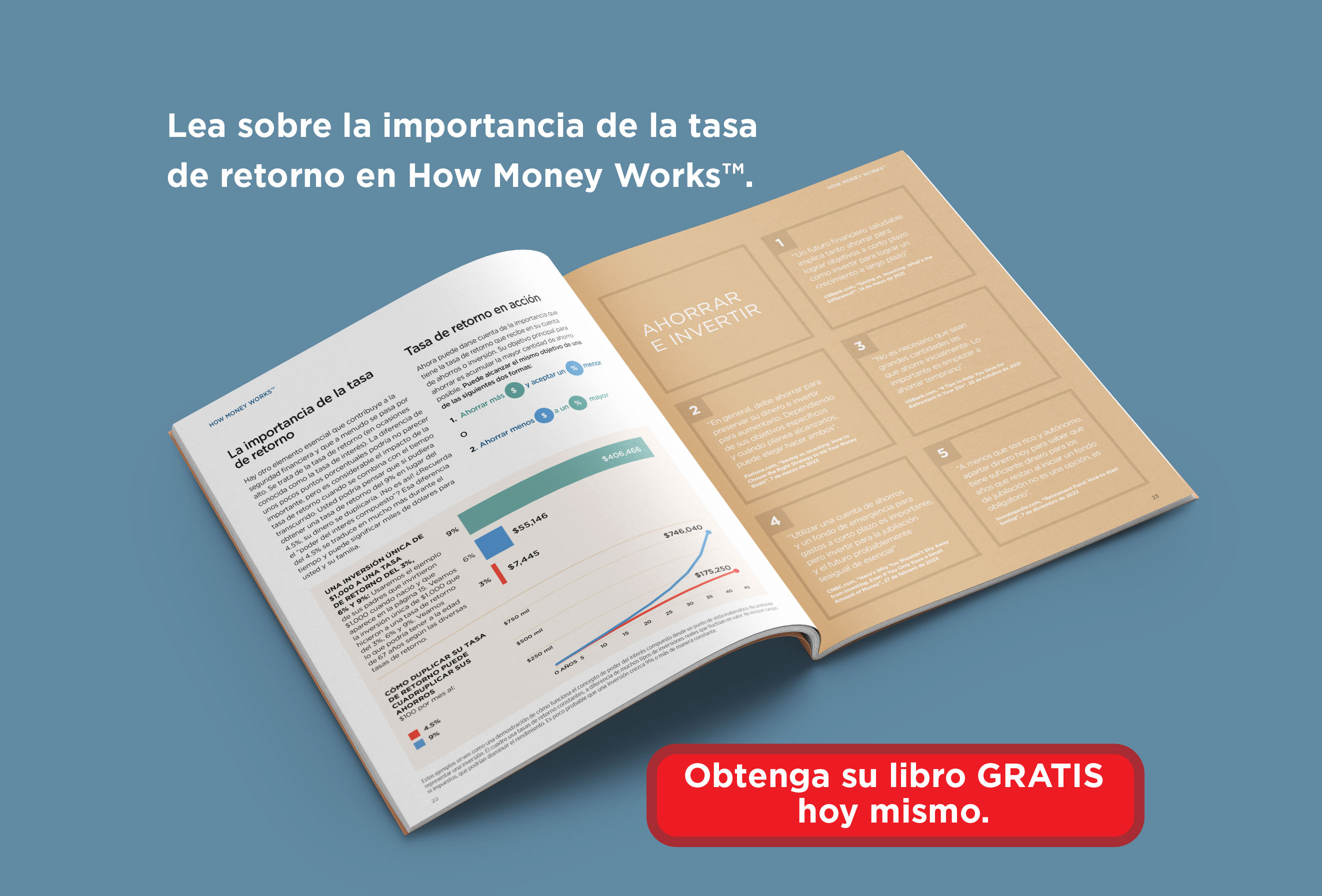

¿Conoce la Regla del 72? Es una manera fácil de calcular cuánto tiempo demorará en duplicarse su dinero.

Para calcularlo, divida el número 72 por la tasa de retorno que espera ganar. Esa cifra le brinda un número aproximado de los años que le llevará para que se duplique su dinero.

Basado en la Regla del 72, un aporte único de $10,000 se duplica seis veces más al 12 por ciento en comparación con el 3 por ciento en 48 años. Cuando se combina con el tiempo transcurrido, es fácil ver por qué la tasa de retorno es clave.

| Años | 3% | 6% | 12% |

|---|---|---|---|

| 0 | $10,000 | $10,000 | $10,000 |

| 6 | — | — | $20,000 |

| 12 | — | $20,000 | $40,000 |

| 18 | — | — | $80,000 |

| 24 | $20,000 | $40,000 | $160,000 |

| 30 | — | — | $320,000 |

| 36 | — | $80,000 | $640,000 |

| 42 | — | — | $1,280,000 |

| 48 | $40,000 | $160,000 | $2,560,000 |

Esta tabla demuestra cómo funciona el concepto de la regla del 72 desde un punto de vista matemático. No pretende representar una inversión. El cuadro usa tasas de retorno constantes, a diferencia de muchos tipos de inversiones reales que fluctúan en valor. No incluye cargos ni impuestos, que disminuirían el rendimiento. Es poco probable que una inversión crezca 10% o más de manera constante.